Chase Freedom Flex Card Designs

Table Of Content

They are based on actual data across a balance of accessible redemption options, not just the aspirational first and business class redemptions that require a PhD in miles and points to book. The upshot is that our valuations help you understand the actual value you can easily get from your miles and points. To request a replacement card, sign in to Chase Online℠ and follow the instructions. We’ll send you a replacement card that'll arrive within 5-7 business days.

Popular Chase Credit Cards

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs. Cardholders also get cell phone protection, which covers up to $1,000 per claim against covered theft or damage for you and your employees listed on your monthly cell phone bill when you pay with your card. In addition to rotating rewards, you can earn 5% cash back on travel booked through the Chase Ultimate Rewards® portal, 3% cash back on dining at restaurants and at drug stores and 1% cash back on all other purchases. Chase's website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit.

NEW CARDMEMBER OFFER

While the card has many notable benefits, it may not be sufficient on its own for consumers who want to maximize their rewards on every purchase. Pairing the Chase Sapphire Preferred with another credit card can improve your overall rewards potential. There are no different Chase Freedom Flex card designs you can pick from. There is only one card design option, and it’s sky blue with a light blue swirl. Cardholders cannot customize the Chase Freedom Flex card’s standard design, or the design of most other Chase credit cards. Cardholders cannot customize the Chase Freedom Flex card’s standard design, or the design of most other Chase credit cards.

Choosing a credit card can be confusing. Chase can help.

I suppose, at the end of the day, we could consider that the card's annual fee may really be the best deal the Chase Sapphire Reserve® offers. Sure, it's a big fee, but the card's rewards, offers, and perks bring a lot of value to the table. For the right cardholder, the Chase Sapphire Reserve® could easily be worth every penny of its annual fee -- and then some. It is worth noting that personal preferences play an important part when it comes to creative credit card designs. Chase will usually approve or deny you instantly when applying for a credit card online.

Amazon credit cards get new names, new looks — and new benefits - Chain Store Age

Amazon credit cards get new names, new looks — and new benefits.

Posted: Mon, 01 May 2023 07:00:00 GMT [source]

However, we may receive compensation when you click on links to products from our partners. If you want a custom design – or semi-custom design – for your credit card but aren’t sure if it’s available, just call your bank or card issuer and ask. Catch up on CNBC Select's in-depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date. Experts generally recommend downgrading your credit card as opposed to canceling as it can have a negative impact on your credit score.

Popular Content

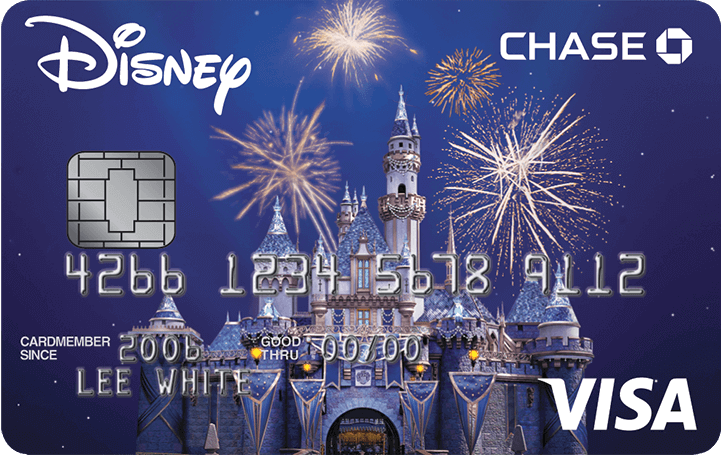

Walt Disney World 50th Anniversary EARidescent Design Now Available for Disney Visa Card - WDW News Today

Walt Disney World 50th Anniversary EARidescent Design Now Available for Disney Visa Card.

Posted: Wed, 22 Sep 2021 07:00:00 GMT [source]

A growing number of credit and debit card companies are allowing their most style-conscious customers to choose from an array of fashionable designs – or customize their credit cards themselves by uploading their own photos. Many of the top credit card and debit card issuers let customers have fun with their card designs. Keep in mind the Sapphire Reserve has a steep $550 annual fee, which is in line with other premium credit cards and can be offset by the numerous statement credit offers. If you want a lower annual fee, consider the Sapphire Preferred ($95 a year). Just like the debit cards, there are a lot of different options to choose from (10 unique designs).

World of Hyatt Credit Card

Small business owners have a lot on their plate, but expenses can be simplified with a small business card, such as the Ink Business Cash® Credit Card. This card has no annual fee and allows you to open employee cards at no additional cost with the ability to set individual spending limits. You'll also receive a $300 annual statement credit to apply to qualifying travel expenses, such as airfare, hotels, tolls and more. This credit can help you upgrade to an extra-space seat or offset the cost of staying another night at a hotel. Below, CNBC Select breaks down the best Chase credit cards into seven categories so you can open the best card based on your spending habits.

Triple points on dining and streaming services is useful, while online grocery purchases may or may not be, depending on your lifestyle. Travel-related purchases are far more lucrative if you’re willing to book through Chase's travel portal. Even if you’re not, Chase’s definition of "travel" is fortunately broad; in addition to airfare and hotel stays, you can also earn bonus rewards on expenses like parking garage fees, bus fares and campgrounds.

Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank's website for the most current information. If you dress with flair or express yourself with accessories, you can add another custom piece to your ensemble – a personalized credit card. Find the best credit card for you by reviewing offers in our credit card marketplace or get personalized offers via CardMatch™.

If you're interested in earning travel rewards, but want something a little easier to use, the $95-annual-fee Capital One Venture Rewards Credit Card has a much simpler rewards structure. The Chase Sapphire Preferred® Card and its more upscale sibling, the Chase Sapphire Reserve®, have had their rewards, perks and bonuses tweaked over the years as the issuer has worked to keep them at the top of travelers' wallets. Yes, you can put a design on a debit card by calling the phone number on the back of the card or ordering online.

It even has a few travel perks, such as primary rental car insurance, trip cancellation/interruption insurance and lost luggage insurance. All those reward categories with different rates, an anniversary bonus and a 1.25 cents per point redemption for travel through Chase? The Chase Sapphire Preferred® Card offers versatility for travelers that's hard to find at a similar price point. For travelers, the $95-annual-fee Chase Sapphire Preferred® Card stands out as a versatile and valuable choice.

Chase isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. If you are going for some of their best rewards cards like the Chase Sapphire Preferred or Chase Sapphire Reserve, you’re not going to be able to customize those credit cards. Chase also offers custom credit cards but not for most of their credit cards. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Furthermore, the Bilt Card offers similar transfer partners to the Sapphire Preferred, including airlines and hotel loyalty programs, allowing cardholders to maximize the value of their points through strategic redemptions.

Chase Sapphire Reserve® cardholders get complimentary Priority Pass membership (enrollment required). This gives you access to more than 1,300 lounges around the world, typically with up to two guests per visit. If you really want a deal, however, you can transfer your points to a hotel or airline loyalty program. These can then be redeemed through the hotel or airline, hopefully at a high rate -- you can get $0.03 or more per point in some cases. Chase doesn’t publicly disclose a maximum credit limit for the Chase Freedom Unlimited card. But some customers have said that they have received limits of almost $14,000.

The Chase Freedom Unlimited card has a credit limit of $500 to $5,000 at a minimum, depending on whether you get approved for the Visa Platinum or Visa Signature version of the card. The Platinum version has a $500+ limit, while the Signature version has a $5,000+ limit. If you have good to excellent credit and you’re in line with Chase’s 5/24 rule, you could be approved for the Chase Sapphire Preferred® Card. Good credit is generally defined as a FICO of 690 or higher, although issuers also take into account your income, existing debts and other information. Points are worth 1.5 cents apiece when redeemed for travel through Chase.

Comments

Post a Comment